Turbocharge Your Real Estate Portfolio with DSCR Loans

Unlimited Funding as Long as Your Property’s Market Rent Covers the Expenses.

How DSCR Loans Help Grow Your Real Estate Portfolio

Curious If Your Property Is A Good Fit for A DSCR Loan?

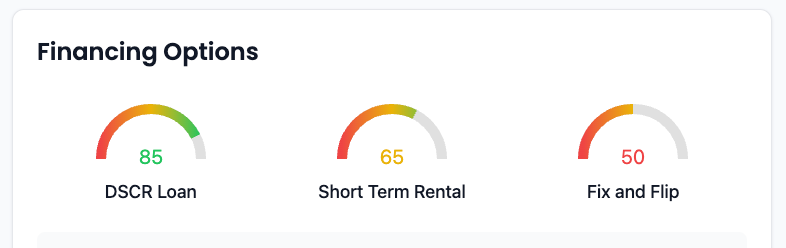

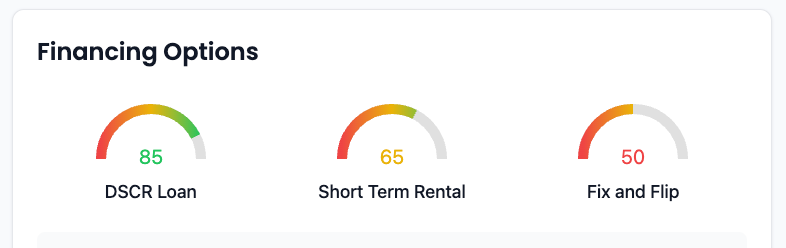

Use our AI powered aiPropNvest tool to make smarter investments. Enter any US property, and it will find the best loan option to help you earn more and reach your goals.

DSCR Loan Approval Process

01

Submit Your Loan

Share basic details about the property and your goals.

02

Property Evaluation

We focus on the property's cash flow to ensure it meets the 1:1 DSCR requirement.

03

Loan Approval & Closing

Once approved, we’ll guide you through closing quickly and efficiently.

Key Features of DSCR Loans

1

Easy Qualification

DSCR loans don’t require personal income or credit evaluations. Approval is based solely on the property’s ability to generate enough income to cover its expenses.

2

Flexible Loan Terms

With fixed interest rates and terms up to 40 years, DSCR loans offer stability and predictable payments for long-term investments.

3

Unlimited Growth Potential

Scale your real estate portfolio without limits, as long as the property’s market rent covers the mortgage, taxes, and insurance.

4

Perfect for Investors

Ideal for tax-savvy investors, self-employed individuals, and those with high debt ratios looking to expand their holdings.

DSCR Loans

DSCR loans are ideal for long-term property investors looking for scalable, predictable financing. Unlike traditional loans, they focus on the property’s income rather than your personal financials, making them perfect for self-employed or tax-savvy investors.

Advantages:

Long-term fixed rates (30–40 years)

No personal income validation required

Unlimited portfolio growth potential

Best For:

Investors looking to scale with stable cash flow.

Investment Loan Options

Short-Term Lease Loans

Designed for vacation or short-term rental properties, these loans evaluate seasonal income potential. While they offer flexibility, they often come with variable terms and higher requirements for market income documentation.

Comparison to DSCR:

Unlike DSCR loans, Short-Term Lease Loans require proof of market demand and are less predictable due to fluctuating rental income.

Best For:

Airbnb or vacation rental investors targeting seasonal income streams.

Fix-and-Flip Loans

Fix-and-Flip loans provide short-term financing for renovating and reselling properties. They are based on the after-repair value (ARV) and are best suited for fast turnaround projects.

Comparison to DSCR:

While Fix-and-Flip loans are quick to fund, they come with shorter terms (12 months) and higher rates, unlike DSCR loans, which provide long-term stability.

Best For:

Hands-on investors aiming to profit from quick property sales.

Loan Comparison

Choose the financing option that’s right for your investment strategy.

Best for long-term property investors.

DSCR

Loan

Property-based approval, not personal income.

Fixed interest rates for 30–40 years.

Scalable, unlimited growth potential.

Minimal documentation required.

Stable, predictable monthly payments.

Best for vacation rental properties

Short-Term Lease Loan

Approval based on seasonal income potential.

Terms vary depending on income consistency.

Moderate interest rates, flexible repayment

Requires proof of market demand and income projections.

Best for short-term project investors.

Fix-and-Flip Loan

Approval based on after-repair value (ARV).

Short terms (12 months)

Higher interest rates, but quick funding.

Ideal for property renovations and resale.

Ready to Maximize Your Investments?

Try the aiPropNvest Tool for Free.

Harness the power of AI with the aiPropNvest tool. Simply input any US residential property into our system, and it will analyze key data to provide a detailed estimate of the best loan option to maximize your returns and align with your investment goals.