Transform Properties with Fix-and-Flip Loans

Fast and flexible funding to buy, renovate, and profit. Perfect for investors using the BRRR method to build wealth.

Start Building Wealth with Fix-and-Flip Loans

Fix-and-Flip loans are the perfect choice for individual property investors looking to grow their portfolio through smart strategies like the BRRR method. BRRR stands for Buy, Rehab, Rent, Refinance, Repeat; a proven system for building wealth in real estate.

Here’s how it works: You buy a property in need of renovations, use a Fix-and-Flip loan to cover the purchase and rehab costs, and then transform it into a rental property. Once it’s generating income, you refinance with a long-term loan to pay off the short-term Fix-and-Flip loan. With this approach, you free up capital to reinvest in your next project and repeat the cycle.

With quick approvals and funding, Fix-and-Flip loans help you move fast to secure properties and bring your vision to life, whether you’re improving distressed properties or adding value through renovations. Start turning potential into profit today.

Curious If Your Property Is A Good Fit for A Fix-and-Flip Loan?

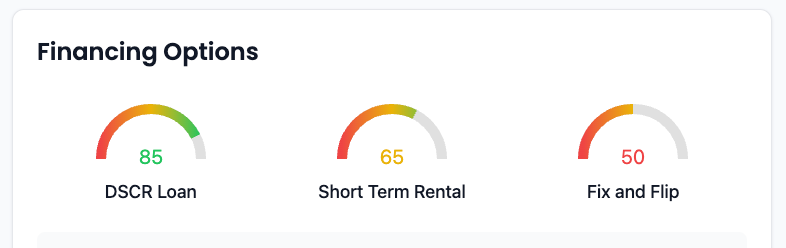

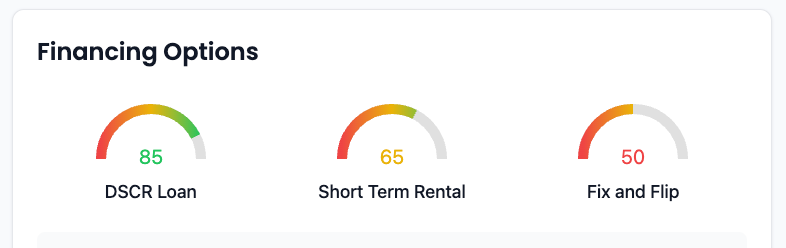

Use our AI powered aiPropNvest tool to make smarter investments. Enter any US property, and it will find the best loan option to help you earn more and reach your goals.

Fix-and-Flip Loan Approval Process

01

Submit Your Loan

Provide details about the property you want to purchase and your renovation plans, including the estimated purchase price, scope of work, and after-repair value (ARV).

02

Property and Project Evaluation

We evaluate the property's potential by analyzing its current value, renovation costs, and projected ARV. This ensures the project meets loan-to-cost (LTC) and ARV requirements, with up to 90% LTC and 75% ARV available.

03

Loan Approval & Closing

Once approved, we’ll help you close quickly so you can start renovations without delay. Our streamlined process ensures you can secure funding and begin your project in as little as a few weeks.

Key Features of Fix-and-Flip Loans

1

No Personal Income Requirement

Approval is based on the value of the property and your renovation plans, not your personal financials.

2

12-Month Loan Terms

Short-term loans designed to cover the purchase and renovation phases, keeping your projects on schedule.

3

Up to 90% Loan-to-Cost (LTC) and 75% After-Repair Value (ARV)

Get financing for a majority of the property’s purchase and rehab costs, maximizing your investment power.

4

Loan Amounts from $100,000 to $2M

Flexible loan sizes tailored to the needs of small and large projects, ensuring you have the capital to succeed.

Fix-and-Flip Loans

Fix-and-Flip loans are a top choice for property investors aiming to purchase, renovate, and resell properties for a profit. These loans are based on the property’s after-repair value (ARV) and are ideal for short-term projects that require quick funding and fast execution.

Advantages:

- Quick funding tailored for short-term renovation projects

- Financing up to 90% of loan-to-cost (LTC) and 75% of after-repair value (ARV)

- No personal income validation required

Best For:

Hands-on investors looking to flip properties within 12 months or those using the BRRR (Buy, Rehab, Rent, Refinance) method to scale their real estate investments.

Loan Options

DSCR Loans

DSCR loans focus on the property’s ability to generate rental income rather than the borrower’s personal finances. They are best suited for long-term investors looking for scalable and predictable financing.

Advantages:

- Long-term fixed rates (30–40 years)

- No personal income validation required

- Unlimited portfolio growth potential

Comparison to Fix-and-Flip Loans:

Unlike Fix-and-Flip loans, which provide short-term financing for fast renovations and resales, DSCR loans cater to investors seeking steady rental income and long-term stability. Fix-and-Flip loans are better for rapid project turnarounds, while DSCR loans are designed for scaling portfolios over time.

Short-Term

Rental Loans

Short-Term Rental loans are perfect for investors entering the vacation rental market, such as Airbnb or seasonal rentals. These loans prioritize the property’s income potential, making them ideal for properties with fluctuating or seasonal rental demand.

Advantages:

- Flexible terms for seasonal income streams

- Finance up to 80% loan-to-value (LTV)

- No personal income validation required

Comparison to Fix-and-Flip Loans:

While Short-Term Rental loans are designed for income-focused investors managing seasonal rentals, Fix-and-Flip loans are tailored for property renovation and resale. Short-Term Rental loans prioritize ongoing rental revenue, whereas Fix-and-Flip loans emphasize quick project completions and profits.

Loan Comparison

Choose the financing option that’s right for your investment strategy.

Best for long-term property investors.

DSCR

Loan

Property based approval, not personal income.

Fixed interest rates for 30–40 years.

Scalable, unlimited growth potential.

Minimal documentation required.

Stable, predictable monthly payments.

Best for vacation rental properties

Short-Term Rental Loan

Approval based on seasonal income potential.

Terms vary depending on income consistency.

Moderate interest rates, flexible repayment

Requires proof of market demand and income projections.

Best for short-term project investors.

Fix-and-Flip Loan

Approval based on after-repair value (ARV).

Short terms (12 months)

Higher interest rates, but quick funding.

Ideal for property renovations and resale.

Ready to Maximize Your Investments?

Try the aiPropNvest Tool for Free.

Harness the power of AI with the aiPropNvest tool. Simply input any US residential property into our system, and it will analyze key data to provide a detailed estimate of the best loan option to maximize your returns and align with your investment goals.